Wallet

A wallet for cryptocurrencies (or crypto wallet) is an application or device to safely store a user´s cryptocurrencies, like a traditional wallet stores money. But instead of holding physical coins and plastic cards, it rather digitally stores the [[private key]] to sign a cryptocurrency [[transaction]] and provides the interface that lets the user access his cryptos [1].

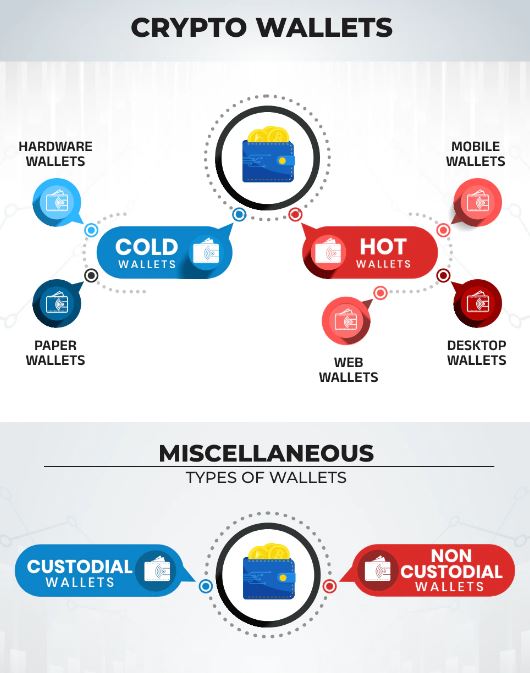

In principal, there are several, very different types of wallets:

### Brain wallets

Brain wallet means that a [seed-phrase](/wiki/Seed-phrase) is stored in a users mind alone, without security risks from computers being hacked or keys get lost or stolen. Apparently the drawback is, If a brainwallet is forgotten or the owner dies or is otherwise incapacitated, then the cryptos are lost forever.

Eg. one can generate a seed phrase using the site https://brainwallet.io/ which converts it into a private and public key pair of a [[Bitcoin]] [[address]]. As long as you remember the seed phrase, you will have access to the value stored at this address.

### Paper wallets

Like the name says, with paper wallets the keys of [[blockchain]] addresses are stored in a physical form and, same with brain wallets, are not saved digitally to increase security, also called "[[cold storage]]". Apart from a simple sheet of paper, there are more elaborate versions using plates of stainless steel which are - unlike paper - fire-proof.

Paper wallets were popular in the early days of [[Bitcoin]] but are now considered as obsolete and unsafe, mainly for two reasons. Printing a paper wallet is problematic, as many printers are connected to the internet or have a hard drive for internal storage (where the paper wallet is saved in the process of printing) [2]. Secondly, a paper wallet consists of a single (Bitcoin) address (whereby more modern wallets can generate new addresses for each [[transaction]]). To withdraw Bitcoins from an address, compromises this address (because it appears online). Therefore paper wallet should be used only once - not very convenient.

### Hardware wallets

These are devices, typical in form of a [[USB drive]] which allow the storage of various crypto assets mostly in [[cold storage]]. For an actual [[transaction]] they have to be connected to the internet but other than that they store the cryptos offline in a convenient way. Additional security against loss of the device is achieved by a [seed-phrase](/wiki/Seed-phrase) that needs to be entered before the device unlocks itself. A damaged device can also be replaced by knowing the seed phrase.

Current examples are [Ledger Nano S Plus](https://shop.ledger.com/products/ledger-nano-s-plus) or [Bitbox02](https://bitbox.swiss/)

### Software wallets

Probably nowadays the most frequently used crypto wallets. Software wallets are software programs, a [[DApp]] or a [browser-extension](/wiki/Browser-extension) that safely store the private keys of crypto assets. As they are connected to the internet in one way or the other, they are considered "hot wallets" (in contrast to "cold" hardware wallets.

There are many different ones, for desktop computers and/or smartphones. Modern software wallets allow in addition as well to handle multiple different cryptocurrencies, to swap between them and some have integrated tools to buy cryptos via [[Fiat money]]. Popular examples are the [Exodus wallet](https://www.exodus.com/) or [Metamask](https://metamask.io/). A software wallet often used on the [[Hive]] [[blockchain]] is [[Keychain]].

Apart from the above types there is another important classification of crypto wallets:

### Custodial wallets

Custodial wallet means that the user does not have access to the [[private key]] of the cryptocurrency directly, but a third party (an exchange or provider of the program) acts as custodian, similar like with traditional banks.

Centralized [[exchanges]] like [[Binance]][3] hold large amounts of user funds in a custodial way. The advantage: the user has not to deal with key storage and has a familiar, easy way of accessing his cryptos. The downside is that if the third party goes bancrupt or is involved in a fraud or scam (like the famous FTX fraud)[4], the user´s crypto assets can be lost overnight!

### Non-custodial wallets

With a non-custodial wallet, only the crypto owner holds their own [[private key]]. No third party is involved and therefore the cryptos are safe from any fraud or exchange [[bankruptcy]].

The drawback is the lack of any recovery options in case a user loses his keys. No help desk or support team can retrieve a lost key.

The users full ownership of their cryptocurrencys in non-custodial wallets is making them responsible for safeguarding their private keys and funds which can be at times overwhelming for non-experienced users, especially when handling multiple different crypto assets. Therefore the level of experience and commitment to learning about [crypto-security](/wiki/Crypto-security) should determine the decision of choosing a custodial or non-custodial wallet.

***

Source: https://www.indiatoday.in/cryptocurrency/story/explained-types-of-crypto-wallets-here-you-all-need-to-know-about-it-2002988-2022-09-21

## References

1. ↑ https://www.investopedia.com/terms/b/bitcoin-wallet.asp

2. ↑ https://en.bitcoin.it/wiki/Paper_wallet

3. ↑ https://www.binance.com/en

4. ↑ https://www.techtarget.com/whatis/feature/FTX-scam-explained-Everything-you-need-to-know

## Related Articles

[[Private key]]

[[Transaction]]

[[Bitcoin]]

[[Address]]

[[Blockchain]]

[[Cold storage]]

[[Usb drive]]

[[Dapp]]

[[Fiat money]]

[[Hive]]

[[Keychain]]

[[Exchanges]]

[[Binance]]

[[Bankruptcy]]

Contents